The Blog Financial reform for EU citizen

22 articles

8 lobby myths about higher capital requirements for fossil banking

With the risk of a “fossil subprime crisis” being a top concern of authorities in charge...

Reading level: Expert

Three months of banking profits could prevent a ‘fossil subprime’ crisis

The world’s 60 largest banks are exposed to around $1.35 trillion in risky fossil fuel assets....

Reading level: Regular

IPCC Report – The UN Urges Act Now to Prevent Climate-Driven Financial Shocks

IPCC confirms without a major shift of financial flows away from fossil finance, massive financial risks...

Reading level: Regular

The Insurance Industry and Climate Change: Shifting the Cost to Policyholders

As stewards of transition, insurers can mitigate climate-related risks and preserve access to affordable insurance for...

Reading level: Regular

Basel approach not sufficient to address climate-related risks

The publication of the “Principles for the effective management and supervision of climate-related financial risks” by...

Reading level: Expert

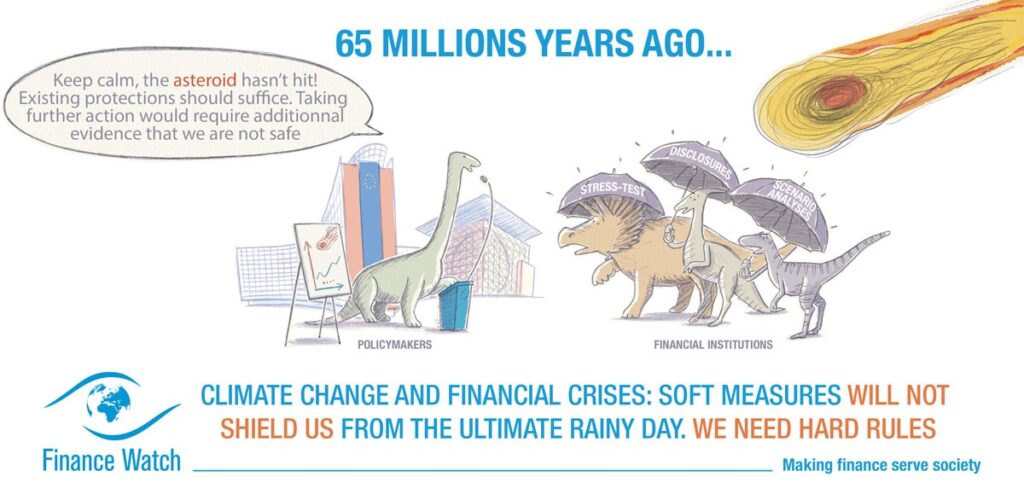

4 reasons why banks and insurers can’t withstand the climate crisis without extra loss-absorption capacity

Reading level: Expert

Climate risk: strong Pillar II prudential measures are needed but not enough

A detailed look at ongoing prudential initiatives under Pillar II shows that they are needed, but...

Reading level: Expert

Climate change: Are markets ready to finance the energy transition?

An overhaul of some economic fundamentals is necessary for finance to really integrate climate change. We...

Reading level: Expert

Capital requirements: a “silver bullet” against the looming climate-induced financial crises

The tremendous macro-economic consequences of the looming climate crisis are forcing financial supervisors to acknowledge that...

Reading level: Expert

Get involved

You can help tip the balance! Strengthen our impact by joining our collective efforts.