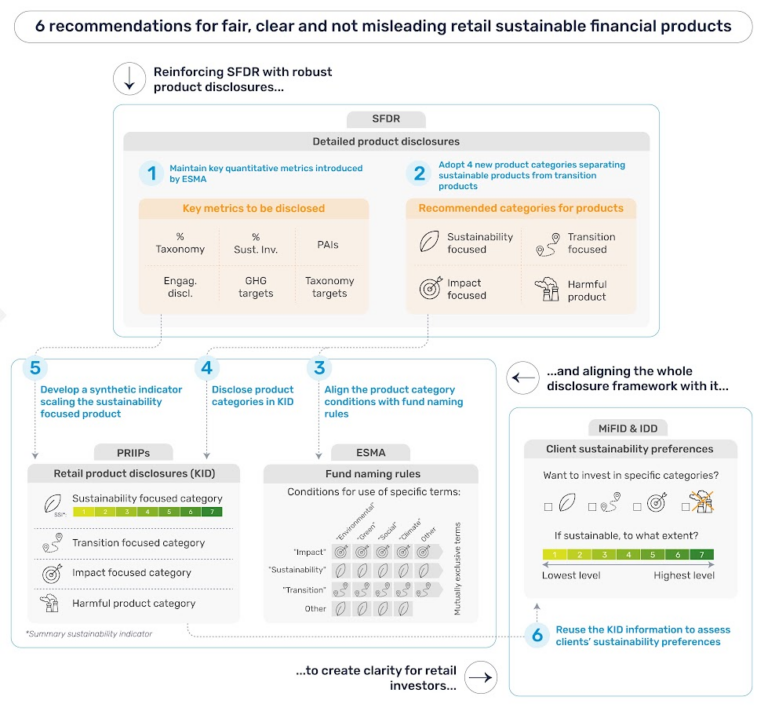

In its reaction to the ESAs’ opinion on the assessment of the SFDRSustainable Finance Disclosure Regulation, Finance Watch calls for improving transparency and understandability for retail investors via 1) the development of a summary sustainability indicator combined with a new product classification and the creation of an additional harmful product category and 2) a coordinated review of SFDR, PRIIPsPackaged retail and insurance-based investment products (PRIIPs) and the consideration of sustainability preferences

The ESAs published on 18 June 2024 an opinion on the revision of SFDR, calling for a coherent sustainable finance framework that caters for both sustainable transition and investor protection, taking into account the lessons learned from the functioning of SFDR. The opinion focuses on (1) the introduction of a new categorisation system, (2) the development of an indicator of sustainability for financial products to enable an easier understanding of their sustainability level, (3) the definition of the notion of ‘sustainable investment’, (4) the possible expansion of products in scope of SFDR, (5) the simplification of the relevant documentation and (6) the improvements to transparency of PAIs (Principal Adverse Impacts) at product level.

Finance Watch welcomes the comprehensive work performed by the ESAs, which may serve as a good starting point to rethink SFDR. Finance Watch also shares attention points on some of the recommendations, including:

- The development of a simplified and dynamic metric – a single sustainability indicator – that clusters products with the same sustainability level would provide simplified and intuitive information for retail investors to understand the sustainability level of a product. Yet, the creation of a single sustainability indicator is only relevant if it is combined with product categories. Moreover, Finance Watch recommends developing such an indicator only for products categorised as sustainability focused to prevent developing an indicator that treats all product categories equally.

- The creation of an additional harmful product category would provide investors with the possibility to exclude harmful investments from their portfolio. It would also incentivise asset managers to take the necessary actions for their products to meet the transition category and not fall under the harmful category.

- The fund naming rules should be enhanced and aligned with the criteria of the product categories.

- The creation of an impact focused category in the SFDR framework is the opportunity of tailoring SFDR for non-traditional financial institutions that base their investment decision-making process on qualitative and principle-based factors rather than traditional quantitative factors. Yet, the notion of impact should be clearly defined to prevent assimilating it to traditional investments.