In this policy brief, Finance Watch makes concrete recommendations for the upcoming EBA requirements on “prudential” transition plans for EU banks in order to bring legal certainty and comparability and make transition planning credible from a risk perspective.

A new requirement in banking rules

Regulators and supervisors are slowly leveling up on banks’ management of ESG risks: the EU co-legislators have upgradedSee the 31 May 2024 trilogue agreement Directive EU 2024 1619 to amend the Capital Requirement Directive. Read also the Finance Watch analysis of the agreement here https://capital-fly.live/press/finance-watch-statement-eu-co-legislators-reach-agreement-on-basel-iii%3C/span%3E%3C/span%3E the prudential framework to include transition riskIn the European Union, the Paris Agreement has been transposed into the binding European Climate Law, which requires carbon neutrality by 2050. The commitment to reduce emissions by 55% by 2030 is further reinforced by the EU’s “Fit for 55” strategy. As the economy transitions towards meeting these goals, industries need to adjust how they operate. And since most companies in the EU with high-emitting production facilities rely on bank financing, this also has a significant impact on banks’ balance sheets. For instance, various studies suggest that phasing out fossil fuels to meet the Paris Agreement may very well leave about 80% of fossil fuel assets stranded in the absence of a timely transition, which will lead to financial losses for banks that are exposed to companies with those assets. For more on how transition risks affect banks: https://bankingsupervision.europa.eu/press/blog/2024/html/ssm.blog240123~5471c5f63e.en.html/ in banks’ own risk assessments. EU banks must now implement a “prudential transition planA prudential transition plan is meant for banks to show how they will manage the outside-in financial risks stemming from the ongoing transition of the world’s economy to net zero in 2050. There is another type of transition plan requirement, a new obligation under the new CSDDD, under which companies should still consider the outside in financial materiality of the risk but also the inside out impact materiality, i.e. the perspective of achieving a positive impact on the institutions’ environment. In the first case, we can speak about a single or financial materiality transition plan (or a “prudential transition plan” in the context of bank supervision), in the second, we can speak of a double materiality transition plan. Read Finance Watch’s take on EU’s patchwork of transition plan requirements https://capital-fly.live/blog/europe-must-harmonise-its-patchwork-of-transition-plan-requirements/%3C/span%3E%3C/span%3E%E2%80%9D%3C/strong%3E with guidelines that should be finalised by the European Banking Authority (EBA) by early 2025.

High stakes for the EBA guidelines

EBA’s final cut on transition plan guidelines is important: overly flexible guidelines would reduce transition planning to a burdensome box-ticking exercise and leave investors and taxpayers exposed to massive unaccounted risks. Making the plans credible requires a holistic integration of transition planning as a risk management tool while more detailed guidelines would also improve legal certainty, prevent duplicative work and provide financial markets with some of the predictability that an orderly transition requires.

A new prudential risk: the “deviation risk”

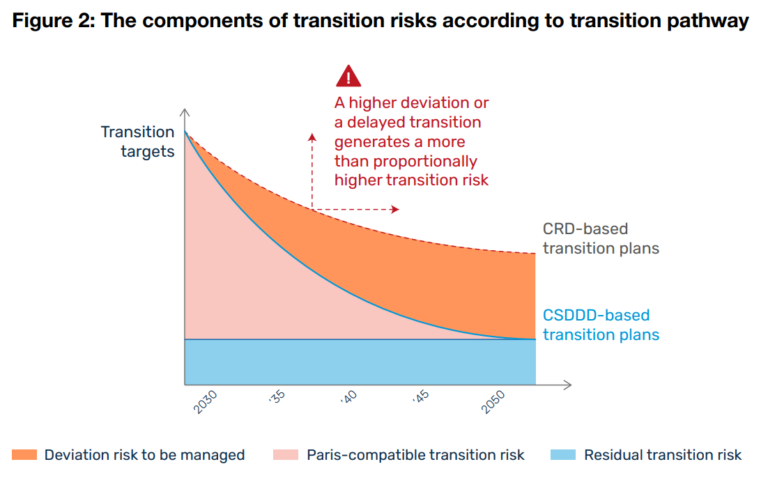

The EBA acknowledged that deviating from a Paris-aligned trajectory creates per se a higher level of financial riskThe transition risk stemming for a business model that would be off-track from a trajectory to be compatible with the Paris Agreement combines the direct financial consequences of deviating from recognized pathways (e.g. controversies, legal actions, cost of capital, loss of business partners) and the risks related to deferred costs of a delayed transition, both at global level (e.g. rising costs from an increase of extreme climate events) and company level (e.g. upcoming investments that are still necessary to meet the GHG emissions reduction targets). And this is only a micro-prudential perspective on transition risk: a deviation from the objectives of the Paris Agreement may also lead to an increase in risks at macro-level as a delay in reaching carbon neutrality is expected to exacerbate the extent and consequences of climate change. Read more on page 18 of the present policy brief: https://capital-fly.live/wp-content/uploads/2024/10/20241017_Policy-Brief_Safe-transition-planning-for-banks_Final.pdf%3C/span%3E%3C/span%3E.%C2%A0 With the focus of “prudential transition plans” on financial materiality, the EBA should specify the practical implications of managing the risk of deviation from the Paris Agreement objectives. Even if they are not all required to implement them, banks should at least design CSDDD-based transition plansAccording to the CSDDD, companies must “adopt and put into effect a climate mitigation transition plan that aims to ensure, through best efforts, that their business model and strategy are compatible with the transition to a sustainable economy and with the limiting of global warming to 1.5 °C in line with the Paris Agreement. Read Finance Watch’s take on EU’s patchwork of transition plan requirements https://capital-fly.live/blog/europe-must-harmonise-its-patchwork-of-transition-plan-requirements/%3C/span%3E%3C/span%3E%3C/strong%3E%C2%A0so as to understand and manage the financial consequences of a possible deviation.

“Figure 2: The components of transition risks according to transition pathway” – Extract from p. 19 of the Finance Watch policy brief “Safe transition planning for banks“

Other Finance Watch recommendations

Beyond this, Finance Watch’s policy brief includes the following recommendations for the EBA and the European legislators:

- Integration into risk management and governance: the credibility of prudential plans relies on the holistic integration of transition planning as a risk management tool. This means embedding transition plans into banks’ governance structures, remuneration policies (which should also be reflected in the EBA guidelines on sound remuneration policies) and risk management processes, including capital and liquidity assessments (ICAAP and ILAAP)Inadequate and low-quality capital and liquidity in banks often increase the severity of financial shocks in the banking sector. Two important processes are central to making banks more resilient and avoiding adverse situations: the internal capital adequacy assessment process (ICAAP) and the internal liquidity adequacy assessment process (ILAAP). The aim of the ICAAP and ILAAP is to encourage banks to reflect on their capital and liquidity risks in a structured way, using bank-specific approaches to measure and manage these risks. Both processes should ensure that banks identify, effectively manage and cover their capital and liquidity risks at all times. Read more here: https://www.bankingsupervision.europa.eu/press/publications/newsletter/2019/html/ssm.nl190213_3.en.html.

- Extended time horizons and a coherent approach to climate scenarios: Transition risk management should shift from relying on historical data to using assessments based on harmonised, forward-looking scenarios. The time horizon for transition risk management should be shifted to 2050 to provide for a coherent view of the transition in line with global climate commitments.

- Clarification on engagement practices: Shareholder engagement and covenantsEquity owners can influence non-financial companies through shareholder engagement, while lenders, insurers and private investors can influence companies by imposing conditions and “covenants” along their financing lines. Read more on how financiers can help the transition in this blog: https://capital-fly.live/blog/beyond-the-illusion-of-net-zero-portfolios-harnessing-finance-to-decarbonise-the-real-economy/%3C/span%3E%3C/span%3E should only be considered as risk mitigation tools if they effectively contribute to the counterparties’ transition, are linked to clear, time-bound objectives, and include escalation processes, potentially leading to divestment for non-compliance.

- Addressing gaps and overlaps in supervisory frameworks: Legislators should clarify the modalities of enforcement of transition plans (and clearly define potential pecuniary sanctions in case of breach) to prevent fragmentation and ensure a consistent interpretation of the requirements between the various entities supervising the implementation of the CSDDD, the CSRD, and prudential rules across Member States.