Finance Watch’s recommendations to align PRIIPS and sustainability preferences with SFDR

Introduction

Over the past years, the Sustainable Finance Disclosure Regulation (SFDR) raised major concerns:

- The flexibility left for defining key concepts (e.g. sustainable investment and the consideration of principal adverse impacts) leads asset managers to publish non comparable product reporting, opening the door to misleading statements.

- The classification introduced to determine the reporting requirements has been misused and Article 8 and 9 classifications have been presented as product labels.

- The absence of a concept of transition in SFDR led to a misleading definition of which investment should be considered as sustainable, as certain asset managers consider transitioning companies as sustainable investments.

- The current product disclosures focus on reporting sustainability characteristics, but do not require reporting the actual adverse impacts of each financial product.

To solve the inconsistencies of the current framework, Finance Watch published a position paper[1] on how the weaknesses of the sustainability transparency framework for financial products could be fixed. However, SFDR is part of an interconnected transparency framework and its revision requires adapting other legislative texts to maintain consistency and tailor transparency rules for retail investors. As a complement to Finance Watch’s recommendations on SFDR, this position paper provides a comprehensive overview of how SFDR could integrate with a review of the Markets in Financial Instruments Directive (MiFID), the Insurance Distribution Directive (IDD) and the Packaged Retail and Insurance-based Investment Products Regulation (PRIIPs).

Key Takeaways

- Align the KID template with SFDR and tailor it for retail investors

The Key Information Document (KID) should be aligned with SFDR disclosures and introduce a summary sustainability indicator for sustainability focused products.

- Align the notion of sustainability preferences with the PRIIPs KID

The sustainability preferences should be redefined in a more comprehensive manner and correspond to the sustainability information available in the KID.

I. Overview of proposed SFDR improvements in a broader context

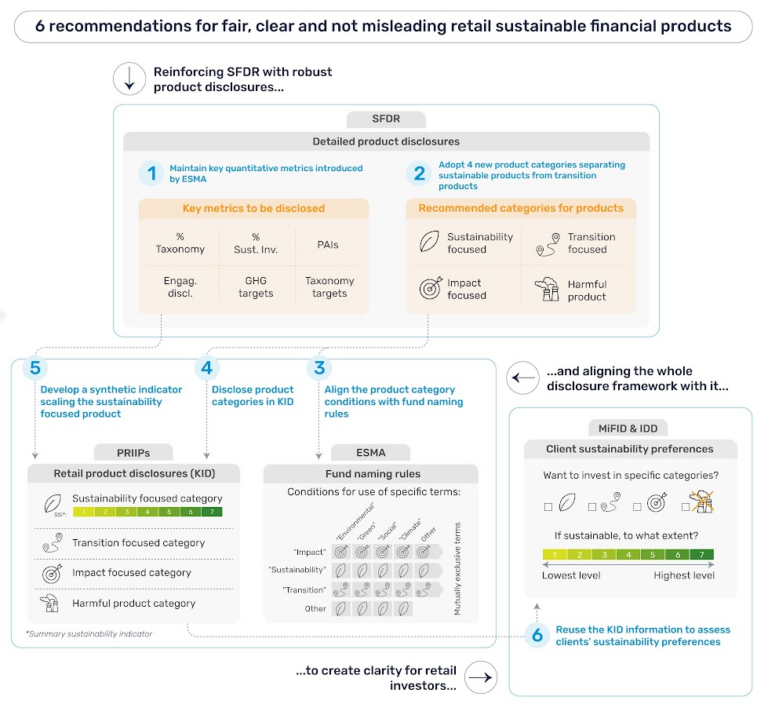

The below diagram highlights the key recommendations for resolving the weaknesses of SFDR and the retail transparency framework. This position paper elaborates on the last three recommendations highlighted in this overview to explain how the retail investor legislative framework could best fit in a revised SFDR. In particular, the document identifies key comprehensive indicators for retail investors that wish to invest sustainably.

II. Focus on the PRIIPS adaptations

Finance Watch recommends aligning the sustainability-related information provided in the SFDR product disclosures and the KID, both concerning the product category and the key disclosures, in a way that it can be understood by retail clients.

The SFDR category of a product is a fundamental element for investors to understand its strategy in relation to sustainability. It should therefore be included in the KID with a clear explanation on what this categorisation entails.

However, the sustainability focused category may, depending on its minimum criteria, cover a large number of products with differing sustainability levels. Yet, retail investors should be able to easily understand the different shades of sustainability when consulting the KID. Designing a summary sustainability indicator (SSI) could be a good alternative to the disclosure of the percentage of Taxonomy alignment and sustainable investment that appear to be difficult to understand for retail investors. The ‘SSI’ methodology would then be dynamic with increasing thresholds to better represent the fund market evolution.

A. Leveraging from product categories (Recommendation 4)

Yes. The SFDR product disclosures include data points that are necessary for investors that wish to invest sustainably but currently remain too complex for retail investors.

The key information document is the right tool for providing retail investors with information on key sustainability characteristics of financial products. Yet, only the most relevant information should be presented in a concise and comprehensible manner for less informed investors. The category of a product – to the extent that appropriate minimum criteria are defined for each product – would provide a simplified understanding of the sustainable strategy of the product. The information should still be accompanied by a brief standardised explanation of what the category entails.

No. SFDR applies to financial products such as UCITS funds, AIFs or managed portfolios. However, the scope of PRIIPs is wider as it covers other types of financial instruments such as derivatives, structured products and warrants. This implies that some of those instruments cannot belong to any category that would be defined under SFDR. Given that the categories intend to reflect sustainable investment strategies, they should not be extended to derivatives, warrants or structured products.

The absence of categories for other instruments covered by PRIIPS does not indicate that they are not sustainable, but simply that they cannot be linked to an investment strategy. However, this will affect the possibility to use product categories when considering clients’ sustainability preferences, as described in the next part of this position paper.

B. Reflecting different sustainability levels (Recommendation 5)

It depends. Provided criteria for transition focused, impact focused and harmful product categories are adequately defined, Finance Watch considers that the categorisation should be sufficient for most retail investors to determine whether they wish – from a sustainability-related impact perspective – to invest in a product under those categories.

However, the sustainability focused category is likely to contain a large number of products with heterogeneous levels of sustainability. We expect the criteria for this category to be sufficiently flexible for a wide range of products to classify under it. We acknowledge the need for clients to be able to identify products with reasonable sustainability features. A category that only covers niche products with high sustainability level may not respond to the needs/preferences of moderate investors interested in sustainable products. Yet, investors should be able to differentiate the shades of sustainability for products falling in the sustainability focused category based on the KID information.

The percentages of Taxonomy alignment and sustainable investments are metrics that appear relevant for clients that wish to invest sustainably. Yet, the product percentages are expected to increase overtime as companies progressively implement the Taxonomy. They also remain largely misunderstood by most retail investors and investment advisors. For example, it is hard for them to understand why – apart from exceptional cases – funds are not yet able to reach a percentage of Taxonomy alignment above 10%.

It would be more intuitive for most retail investors to express their preferences on a scale that would rank products available on the market. For that reason, the development of a Summary Sustainability Indicator (SSI) leveraging from the Summary Risk Indicator (SRI) – a ranking from 1 to 7 assessing the risk of a product – appears to be a good solution.

This ranking would make it possible to compare products based on a relative scale (e.g. the most sustainable products obtaining an SSI of “7”), similar to the energy performance certificates (EPC) of buildings.

Before defining the methodology, it is important to remember that the purpose of the SSI proposed in this document is not to introduce a new definition of sustainable investment, but to translate existing metrics into a synthetic value that can be understood by retail clients. In the same way, the EPC of a building – based on a value from A to G – translates numeric values on the energy consumption of a building into a more intuitive value for retail consumers.

In that context, the SSI could rely solely on a combination of the Taxonomy alignment and in the absence of a social Taxonomy, a metric that reflects socially responsible activities. This second metric could be the concept of sustainable investment, to the extent that this metric is better defined and normalised across the market. The combination of the proposed metrics would then result in a single value that would be used to determine the SSI with a similar approach as the EPC (e.g. based on the distribution of the results). In other words, the SSI would translate an absolute value (e.g. a percentage of Taxonomy alignment) in a relative assessment (e.g. positioning of the product compared to the market).

Yes, when the information is relevant. Although this would not imply the creation of a separate section in the KID, it is important that both transition risks and physical risks are adequately reflected under the section related to risk-return.

III. Focus on the MiFID and IDD adaptations

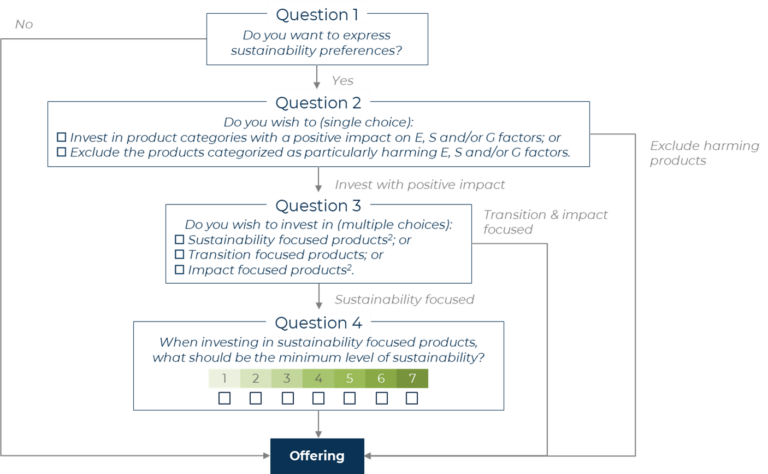

Finance Watch recommends aligning the information used for considering the clients’ sustainability preferences with the information available in the PRIIPs KID.

The use of comprehensive product categories and the summary sustainability indicators is an opportunity for retail clients to express their preferences in an intuitive manner. In case a client wishes to further analyse the sustainability-related characteristics of products, they may refer to the more detailed SFDR disclosures. Yet, this approach requires solving the difference of scope between SFDR, PRIIPS and MiFID/IDD.

A. Reflecting SFDR changes in the sustainability preferences (Recommendation 6)

Sustainability preferences should be aligned with the content of the KID (a simplified questionnaire is proposed in annex). This alignment between PRIIPS and ‘ESG MiFID/IDD’ is key to prevent confusion among retail investors. A client should therefore be allowed to:

- require that their managed portfolio or their advised transactions respect the new ‘positive’ SFDR categories; and

- if they wish to invest in sustainability focused products, express a minimum SSI.

The development of a methodology periodically reviewed based on a market assessment will take into account the evolution of the market offering. The implementation of the Taxonomy is progressive and we expect a continuing increase of the Taxonomy alignment of financial products, explained not only by the transition of the companies but also by the increasing number of companies reporting their Taxonomy alignment.

Currently, a retail client who provides sustainability preferences may provide a minimum percentage of Taxonomy alignment that will be based on the current offering. However, the timing of review of those preferences is usually aligned with the review of the client MiFID profile (usually every 5 to 8 years for more conservative profiles). This means that the client will keep the preference for a low percentage of minimum Taxonomy alignment for years, although the Taxonomy alignment of financial products is expected to increase.

An evolving SSI would be a solution to this limitation as:

- it would keep client’s sustainability preferences aligned with the market evolution;

- it would incentivise asset managers to keep their existing offering aligned with the market evolution to prevent a change in the product SSI, which could make the clients’ portfolio unsuitable.

Yet, if the portfolio/product becomes unsuitable following a review of the SSI, clients should have the possibility to adapt their portfolio free of charges.

SFDR covers disclosure requirements for financial products, while the IDD/MiFID suitability test applies for portfolio management and investment advice on financial instruments and insurance-based investment products. The concept of financial instrument is broader than the concept of financial product as it includes, among other things, derivatives, structured products, as well as stocks and bonds.

This means that if an investment firm relies solely on the KID, it would not have the necessary information to confirm the suitability of financial instruments that are not financial products. A corporate bond, for example, would not be assigned a product category or an SSI. Finance Watch identifies three possibilities to address this issue:

- Define a methodology to categorise all instruments and determine their SSI;

- Extend the notion of financial products to cover “advised portfolios”; or

- Limit the scope of the consideration of sustainability preferences for financial instruments that would qualify as financial products, given that most advice provided to retail investors concerns financial products (as per the current definition).

As revisions of SFDR would most probably not apply before 2028, several “quick fixes” should be made in the ESMA guidelines and EIOPA guidance on the consideration of sustainability preferences:

- Adapt the definition of sustainability preferences in the ESG MiFID and ESG IDD delegated acts to allow clients to express a combination of preferences that would not be considered as alternatives;

- Develop a mandatory questionnaire template to ensure that the way sustainability preferences are collected is not misleading for clients;

- Introduce minimum requirements for the ‘standard sustainability criteria’ that may be proposed by investment firms when clients prefer not expressing detailed preferences but still wish to invest sustainably.

Conclusion

The recommendations made in this position paper would better equip retail investors to invest in the sustainable transition. The position paper also highlights the more fundamental need to consider a combined review of SFDR, the fund naming rules, PRIIPs and the MiFID/IDD delegated acts to foster consistency and ease of implementation.

Vincent Vandeloise, Senior Research & Advocacy Officer at Finance Watch

+32 2 880 04 37

Download the PDF version

Sustainable-investing-Tailoring-the-transparency-framework-for-retail-investorsFootnotes

[1] Finance Watch, Rethinking SFDR: Finance Watch’s proposal in 10 questions, May 2024.

[2] The distinction between sustainability focused and impact focused categories would not be intuitive for most retail investors and both concepts should therefore be backed with an explanation of their differences and accompanied with concrete examples.